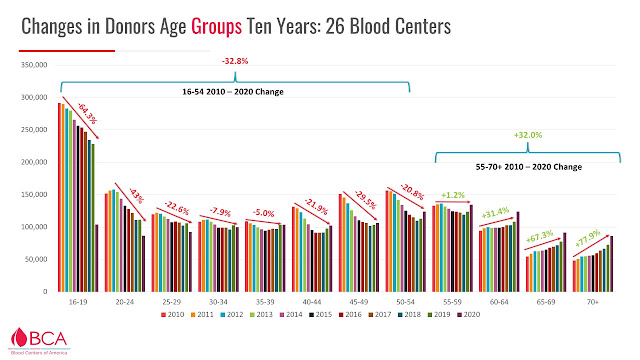

In a survey of >25 US blood centers' annual donor data 2010-2020 inclusive, donations were down in all age groups <55 (even after being normalized for COVID impacts) and donations in most age group were down 21-64%.

Cell Therapy Blog

Business news and analysis for executives in the cell therapy and regenerative medicine industry.

Wednesday, February 2, 2022

Cell and Gene Therapy Industry - Source Material Survey

Sunday, December 5, 2021

Lesson 2 for Mentees from a Seasoned Career-Changer (a series)

In this second lesson in my series of 'career-advice-I-wish-I-could-give-myself-30-years-ago', I treat two more popular career platitudes to my own irreverent perspective and take a shot at some of the most common excuses people use for not pursuing the career they wish they had.

Lesson 2 - more platitudes and a kick in the pants

For the most part, jobs are given to those who earn them but not necessarily those that deserve them. You may deserve a job - you may have all the qualifications and more - but not be offered it because you didn't earn it. You may earn a job you don't really deserve. To earn a job involves people skills - its about more than you can put on paper, more than your credentials or accomplishments. It's the soft skills that can leapfrog you into places you don't belong. You've got to check some boxes but box-checking alone may leave you stranded in a job well below what you deserve but for your inability to 'earn' a better one.

Friday, November 19, 2021

Lesson 1 for Mentees from a Seasoned Career-Changer (a series)

I've changed careers too many times and I've left a lot of money on the table but it has been a scintillating, inspiring, and educational adventure.

In this first lesson I've taken three popular platitudes tossed around when giving career advice and given them my own treatment based on my experience and what I wish I could tell myself 30 years ago.

Lesson 1 - the platitudes

Platitudes, like stereotypes, biases, and gut reactions, exist for a reason - because experience and evolution has taught us there is some truth in them but they are not to be relied upon without rational input. Here are my thoughts on three of most common career-focused platitudes.

Follow your passionsI'll start this one by admitting there are plenty of people who are rewarded financially without taking much risk at all. The 'investors' who make it big with OPM (other people's money), the trust fund kids, the baby boomers who rode a real-estate wave and retired wealthy almost regardless of what they did, etc. Financial reward is not the kind of reward I'm addressing here. I'm not giving financial advice here; I'm giving heartfelt career advice. To have a rewarding career, one must take risk. That risk doesn't always have to look like the big gamble - like mortgaging your house to finance a startup. Sometimes its about trade-offs or sacrifices or taking the path few people agree is the right one.

Again, this comes back to following your passion and following your instincts. One of my favourite jobs was teaching. When I decided to take my Bachelor's of Education there were no teaching jobs - no one thought it was a smart career choice. I didn't know better, I just chose to ignore the common wisdom and follow my instincts - follow my interests, pursue my passion for learning (for which all things related to 'school' was a surrogate). I took that risk. A great teaching job was my reward.

In 2006 (later in life), I left a great job with great pay with a great company with great growth potential in a great industry with a great mentor to start my own consulting company. No one thought that was a good idea. I took that risk. My reward was six years of the kind of education which only exposure to an enormous breadth and depth of companies, technologies, people, methodologies, and business models can provide.

Sometimes the risk you need is not making a change. For me, the risk of not exploring 'the alternative' is one of the hardest to accept. For the last few years, taking the risk of staying put and not chasing the next shiny opportunity has rewarded me with the lessons I needed to learn by seeing things through.

There are others who consider the reward to be all about minimizing all avoidable risk. "No risk is the reward" is their mantra but they are risking something - maybe it is living a more interesting life or seeking out the rewards of a life that takes risk

There is always a 'risk'. Whether you think so or not, every time you choose to do something you're inevitably deciding not to something else. Be conscience of that. Be okay with that. Be aware of the rewards of your decision - even ones you hadn't anticipated or were originally the basis of your decision - but also be aware to what you're not doing by putting yourself on a particular trajectory.

--

All that leads me to my own bonus 'platitude': trust your instincts as much as your logic. I wish my friend John had let himself be a professional musician because he would have rocked it but that wasn't his path and I believe he has been true to himself. I've been told so many times I should 'be' various things I was good at that were not my passion. Many of these things were very logical - clear job opportunities with lucrative and secure futures - but they did not align with my passion. I've also left things I was very much enjoying and passionate about to pursue things I was even more passionate about.

You'll face those moments where you feel pressured to make the 'right' choice - by family or friends or advisors or even the logical side or your brain. Don't ignore that but - and this is particularly important for those of you who love math/science - logic/reason is much more contextual than most care to admit. Logic - in the philosophical sense - would not have you ignore your passions, your interests, your loves. The earlier you learn in life (and in your career) to follow what some might call your 'instincts', the happier you will be.

So what has this lesson been about? Firstly, know yourself and prepare to be true to what drives you. Sometimes your job will be a means to affording your passion, sometimes your passion will decide your career, and sometimes you'll find - or even create - jobs which suit your passion.

People often say "find your passion" as if it were some treasure which, when found, is the magic to happiness. I prefer - as the image says above - "live your passion" because it is a journey and you know what they say about journeys vs destinations.

Make choices to do what you love and love what you do and when you do you'll be good at it and that - quite simply - is the reward.

6 Lessons for Mentees from a Seasoned Career-Changer (a series)

I've had wonderful mentors throughout my career. Recently I've had several invitations and opportunities to start paying back by being a mentor at work, through the ESP program sponsored by ISCT, and giving talks to young professionals. It has really made me think about my own career and what advice I would give myself 30 years ago.

As part of that exercise I've come back to this blog to write down some of the hard-earned, experienced-based lessons I take with me into the last decade (or so) of my career.I've broken down my thoughts into "6 lessons" - a draft outline sketched out below - which I will write about over the coming weeks. It's a useful exercise for me as I consider what value I can share my mentees and since I'm doing it anyway, I might as well share it in hopes that it triggers others to use, engage with, and share what they find useful or things they might add.

Lesson 1 - the platitudes

- Follow your passions

- Do what you love, and you'll be good at what you do

- No risk, no reward

Lesson 2 - more platitudes and a kick in the pants

- All good things come to those who wait (but not for those who wait around)

- Be careful what you wish for you just might get it (so be prepared - go in eyes wide open)

- I can't. I don't have time. I'm not qualified. I don't know how. And other lame excuses

Lesson 3 - its all up to you

- It's your career. Manage it like a company

- Perception is everything (or, at least, it is your reality)

- Not deciding is the same as deciding (there's a time for thinking and a time for doing)

- Pretending you know, helps no one. Be smart - look dumb - ask questions.

Lesson 4- its about the peeps

- It's all about the people (invest in relationships)

- Do unto others as you would have them do unto you

- Never avoid conflict (but rarely engage in it - make the tough conversations the easiest ones)

- Take time to be a mentor

Lesson 5 - be judged by how you helped

- Make your mark by contributing (not boasting or boosting)

- See a need - get on with (addressing) it

- Small scale can scale so don't let the end scare you into not beginning

- You can turn anything around, one person/thing at a time

Lesson 6 - thinking matters, doing matters more, thinking about what you're doing matters most

- Goals are good, plans seldom work

- Vision is good, execution is better

- Never forget to spend some time looking at the big picture

- Invest in your context

Wednesday, November 17, 2021

First allogeneic stem cell therapy approval in Japan

In September 2021 Takeda Pharmaceutical's Alofisel (approved in the EU in 2018) was approved for the treatment of complex perianal fistulas in patients with non-active or mildly active luminal Crohn’s disease.

This was Japan's first allogeneic stem cell therapy approval.

Today, Japan’s reimbursement policy panel approved the listing of Alofisel, with an NHI price of 5.62 million yen (~USD $50,000). It will join the NHI price list on Nov 25. https://pj.jiho.jp/article/245593

Alofisel, granted RMAT designation in 2019, has not yet been approved in the U.S.

Friday, August 6, 2021

Foreign company pursuit of cell therapy commercialization in Japan: strategies and considerations

I'm thrilled to announce that I will be presenting at the upcoming 5th Annual Cell & Gene Therapy World Asia, live streaming on 15th and 16th September 2021.

I will be presenting on "Foreign company pursuit of cell therapy commercialization in Japan: strategies and considerations" at 9:30AM (Singapore Time) on 16th September.

My presentation will cover the following topics:

· Unique constraints and opportunity for regenerative medicine in Japan

· Practical strategies for building a virtual team to support real progress

· PMDA conditional approval -- not the only expedited commercialization pathway in Japan

In preparing for this presentation, I had opportunity to speak with Gladys Koh of IMAPAC to discuss

1. key trends shaping the cell therapy industry moving forward in a post-pandemic world in Asia

2. exciting technologies or developments that have caught my attention in the past year

3. thoughts on how regulations pertaining to cell therapies can be evolved to allow the progress of the industry

4. current struggles with respect to commercialization of cell therapies and how would they might be overcome

5. key challenges this industry faces and is currently trying to overcome

6. developments should the industry look out for from RepliCel Life Sciences Inc. in the coming year

8. some of the key takeaways the audience can expect from my presentation

To view the interview, https://youtu.be/p2oZPbgFkMQ

Click here and here for a written advance peak at a few thoughts from some of the following speakers involved in the event such as:

Gregory Fiore, President & CEO, Exacis Biotherapeutics, USA

Zhimei Du, Global Head Process Cell Sciences, Cell/Gene Therapy, Merck & Co, USA

William Hung, Assistant General Manager, MariaVon, Taiwan

Hardy TS Kagimoto, Chairman & CEO, Healios, Japan

Pascal Touchon, President & CEO, Atara Biotherapeutics, USA

Joy (Shuxia) Zhou, Head of Drug Product Development, Cell Therapy, Takeda, USA

Magali Taiel, Chief Medical Officer, GenSight Biologics, France

Andreas Weiler, Global Head of External Supply Cell & Gene Therapy, Novartis, Switzerland

Seong-Wook Lee, President & CEO, Rznomics Inc., Korea

Yu Zhang, SVP & Chief Scientific Officer, VCANBIO Cell & Gene Engineering, China

Shi-Jiang (John) Lu, President and CEO, HebeCell Corporation

Devyn Smith, CEO, Arbor Biotechnologies, USA

Lee Buckler, President & CEO, RepliCel Life Sciences Inc.

Thursday, July 15, 2021

Cell and gene data innovation and multi-stakeholder data transfer

Hello readers. It's been awhile. I'm pleased to be working with Reuters on some events including this upcoming webinar on how to utilize RWD in cell and gene therapies with speakers from Novartis, BMS and Salesforce. Click here for more info.

The requirements of complex and delicate value chains within cell and gene therapies (CGT) is something pharma has traditionally never seen before. Leaders in CGT are innovating data sharing approaches by utilizing RWE and RWD across the value chain, and achieving multi-stakeholder alignment, to ensure commercial success.

Join C> delivery

trailblazers BMS, Novartis and Salesforce to learn how to turn data in

to true insights: that enhance the science, reduce the cost of deliver, improve

commercial decision-making and elevate the patient experience.

Sign up for the webinar “Cell and gene data innovation

and multi-stakeholder data transfer” here.

When you join, you will learn

how to:

•

Reimagine the

technology: digitally transform existing data integration models for cell and

gene therapies

•

Reach for the future

together: develop a multi-stakeholder strategy collaboratively, that aligns on

needs and capabilities

•

Cross-capture and

utilize data flow from R&D through to launch to win the marketplace with

science and data

•

Prepare for and

address the major barriers to success: such as infrastructure non-readiness,

digitally siloed stakeholders, underdeveloped partnerships, and data illiteracy

•

Turn data in to true

insights: that enhance the science, reduce the cost of deliver, improve

commercial decision making and elevate the patient experience

Please also feel free to

share with your colleagues working in C&G therapy, so they can benefit

too.

Lee